Maximize Efficiency with the Best Payroll Apps: A Comprehensive Guide

Why Choose the Best Payroll Apps?

In today’s fast-paced business environment, managing employee payroll efficiently is crucial for success. The right payroll app can streamline processes, reduce errors, and save valuable time that can be redirected to core business functions. Therefore, investing in best payroll apps is essential for any organization, regardless of its size or industry. This section explores the reasons behind choosing cutting-edge payroll applications, their significant impact on business operations, and the essential features to look for in these tools.

Understanding Payroll Needs

To begin with, it is vital for businesses to assess their payroll needs accurately. Payroll encompasses much more than mere salary calculations; it includes tax withholding, benefits management, compliance with labor laws, and record-keeping. Understanding the unique requirements of your organization helps in selecting a payroll app that best fits your operational style.

Different organizations have varied payroll requirements based on factors such as employee count, the diversity of worker types (full-time, part-time, freelance), and specific industry standards. For instance, a startup might have straightforward payroll needs, while a multi-national corporation requires a more robust and adaptable solution that accommodates complex tax laws across different regions.

The Impact of Efficient Payroll Solutions

Utilizing an effective payroll app can lead to significant cost savings and improved productivity. According to research, businesses that automate their payroll processes reduce time spent by up to 80% compared to manual methods. This efficiency translates to fewer errors, such as miscalculations, which can lead to potential compliance issues or employee dissatisfaction.

Furthermore, a well-designed payroll solution can enhance employee morale. When employees are paid accurately and on time, it fosters trust within the organization. Additionally, payroll apps typically offer self-service features for employees to check their pay stubs, tax deductions, and benefits, further streamlining communication and reducing administrative burdens.

Key Features to Look for in Payroll Apps

When selecting a payroll app, certain features can significantly enhance its effectiveness. Below are the key attributes to consider:

- User-Friendly Interface: A simple and intuitive layout ensures that users can navigate easily without extensive training.

- Automated Tax Calculations: The app should automatically calculate local, state, and federal taxes to ensure compliance.

- Direct Deposit Options: Employees prefer the convenience of having their salaries deposited directly into their bank accounts.

- Time Tracking Integration: Integrating time tracking with payroll prevents discrepancies between hours worked and hours paid.

- Compliance Management: The app should adapt to changes in tax laws and labor regulations, providing peace of mind regarding compliance.

- Robust Reporting Tools: Analytic capabilities allow businesses to understand payroll trends and forecast future expenses.

Top 5 Best Payroll Apps Reviewed

To provide further clarity in your search for the ideal payroll app, we will present a detailed review of the top five payroll solutions currently available in the market. Each app will be evaluated based on features, user ratings, pricing structures, and more.

Comparative Analysis of Features

Below are the top five payroll apps and a comparison of their key features:

| Payroll App | User-Friendly Interface | Automated Tax Calculations | Reporting Tools | Direct Deposit |

|---|---|---|---|---|

| Gusto | Yes | Yes | Advanced | Yes |

| Paychex | Moderate | Yes | Standard | Yes |

| Justworks | Yes | Yes | Basic | Yes |

| Zenefits | Good | Yes | Customizable | No |

| ADP Workforce Now | Complex | Yes | Advanced Analytics | Yes |

User Ratings and Feedback

For many businesses, user ratings and feedback from peers can influence app selection. The following are average ratings from various review platforms:

- Gusto: 4.8/5 – Highly praised for its ease of use and excellent customer service.

- Paychex: 4.2/5 – Recognized for its comprehensive HR solutions but noted for its complexity.

- Justworks: 4.5/5 – Valued by small businesses for straightforward pricing and friendly customer support.

- Zenefits: 4.0/5 – Lauded for HR features but criticized for its payroll functionality.

- ADP Workforce Now: 4.1/5 – Comprehensive features but can be overwhelming and expensive for small companies.

Pricing Structures and Plans

Evaluating the pricing structures can help identify which payroll app aligns with your budget. Here’s a breakdown of the plans offered by our top picks:

- Gusto: Starting at $39/month + $6 per employee.

- Paychex: Custom pricing; starts at around $60/month depending on features.

- Justworks: Starting at $49/month + a small percentage of payroll.

- Zenefits: Starting at $10/month per employee; add-on features may incur additional costs.

- ADP Workforce Now: Custom quotes based on company needs; typically starts at $150/month.

Implementing Payroll Apps in Your Business

Adopting a new payroll app is not merely a technological switch; it requires meticulous planning and execution. This section outlines how to successfully integrate a new payroll app and ensure your business reaps the full benefits of the software.

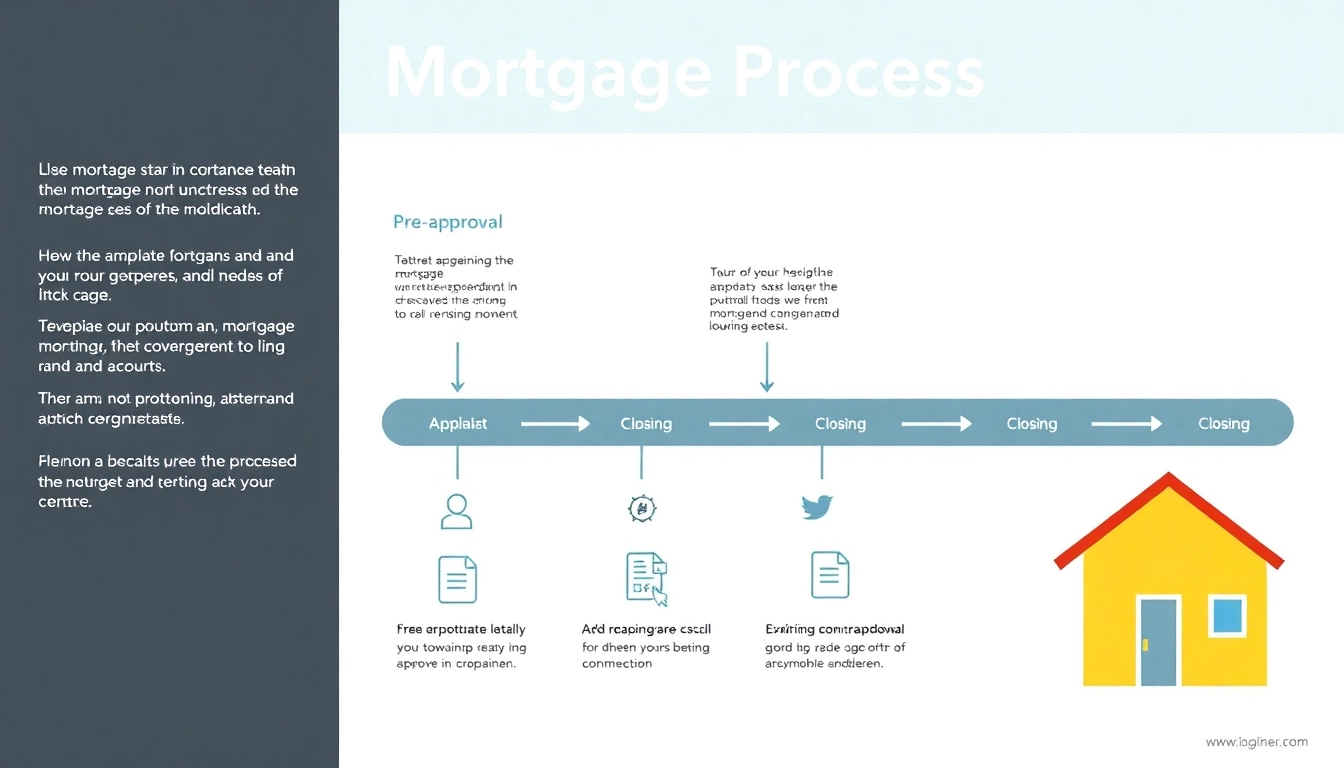

Steps for Successful Integration

The integration process can be broken down into several significant steps:

- Assess Current Systems: Evaluate your existing payroll processes to identify inefficiencies and areas for improvement.

- Choose the Right App: Based on your assessment, select a payroll app that best meets your needs and budget.

- Data Migration: Safely and accurately migrate existing payroll data to the new system to prevent discrepancies.

- Custom Configuration: Set up the app according to your business rules, including tax codes, employee classes, and payment schedules.

- Testing: Conduct thorough testing to ensure that all integrations are functioning as expected before fully launching the app.

Training Your Team on New Tools

Once the app is set up, investing time in training employees on the new system ensures smooth onboarding and usage. Consider the following training methods:

- Workshops: Organize hands-on sessions with a focus on app features, benefits, and troubleshooting.

- User Manuals: Provide comprehensive guides that employees can refer to at their convenience.

- Support Channels: Establish a support framework where employees can ask questions and resolve issues quickly.

Common Challenges and Solutions

Along with the benefits of adopting a payroll app come certain challenges. Here are a few common issues businesses face and solutions to address them:

- Resistance to Change: Employees may be hesitant to adopt new technology. To counter this, highlight the efficiency benefits and provide adequate training.

- Data Accuracy: Errors in data transfer can lead to payroll problems. Maintaining close attention to data accuracy during migration is crucial.

- Compliance Risks: Keeping up with ever-changing tax laws can be daunting. Ensure your app is regularly updated and consider consultative services for additional support.

Performance Metrics for Payroll Apps

Measuring the efficiency of payroll applications is essential for understanding their impact on your organization’s processes. This section discusses relevant performance metrics that businesses can track to gauge the effectiveness of their payroll systems.

Measuring Efficiency Gains

One of the most crucial metrics to examine is the reduction in time spent on payroll tasks. This can be assessed by comparing the hours spent on payroll processing before and after implementing the app. A well-functioning payroll system should reduce time spent on payroll administration, allowing HR and finance teams to focus on strategic initiatives.

Additionally, tracking the frequency of payroll errors can serve as a benchmark for improvement. Modern payroll apps tend to minimize errors significantly, and as a result, a reduction in error rates indicates better efficiency.

Cost-Effectiveness Analysis

Analyzing costs associated with payroll processing is another critical aspect. Businesses should assess whether the payroll app’s operational costs align with the savings garnered from time reduction, fewer errors, and improved employee satisfaction. A cost-benefit analysis can help in understanding the return on investment (ROI) generated from payroll automation.

In comparing costs, consider both direct costs (subscription fees, training expenses) and indirect costs (time saved, improvements in employee retention and productivity).

Long-Term Benefits for Business Growth

Beyond immediate financial metrics, the long-term benefits of implementing a payroll app can significantly influence business growth. These benefits may include:

- Scalability: An efficient payroll app can grow alongside your business, accommodating increasing employee counts without compromising service quality.

- Improved Focus on Core Operations: With payroll tasks automated, teams can invest their time in more strategic activities that drive business goals.

- Stronger Employee Relations: With clarity and transparency in payroll processes, employee trust in the organization enhances, leading to better workplace morale and retention.

Future Trends in Payroll Management

As the technological landscape evolves, so does payroll management. Understanding emerging trends can help businesses stay ahead of the curve and fully leverage the potential of payroll applications in their organizations.

Technological Innovations

Emerging technologies such as artificial intelligence (AI) and machine learning are set to revolutionize payroll management. These innovations can automate complex tasks, enhance data accuracy, and provide personalized services based on employee needs. For instance, AI-driven payroll systems can analyze historical data to predict payroll needs, which will further optimize cash flow and budget management.

Furthermore, blockchain technology could enhance data security and transparency in payroll processing, giving employers and employees peace of mind regarding sensitive financial information.

Shifts in User Expectations

Today’s employees are more tech-savvy than ever before, leading to a rising expectation for user-friendly interfaces and superior customer support from payroll solutions. Companies are now tasked with providing seamless integration of payroll apps with other business applications, mobile accessibility, and streamlined communication channels.

As remote work continues to grow, employees seek tools that are not only effective in processing payroll but also adaptable to various work environments. This trend compels businesses to choose payroll solutions that provide flexibility and accessibility.

Ensuring Compliance with Regulatory Changes

As workforce regulations change frequently, payroll apps must adapt to various compliance standards. Future-proof payroll solutions will need to incorporate automatic updates and ensure services remain compliant with local, state, and federal laws.

Regular audits and monitoring features will also play a crucial role in identifying potential compliance issues before they escalate, ensuring that companies remain diligent in their payroll practices.

Post Comment